Leverage is the Weapon of the Wealthy

Did You Know?

Your success in reaching your Retirement Income Goals depends 3-times more on the amount you save, than it does on your rate-of-return (see pie-chart below). Kai-Zen® is a unique cash-accumulating life insurance policy utilizing leverage. Kai-Zen® offers an opportunity to participate in market growth, eliminate the risk of market declines while also providing protection for you and your family. This unique approach to using leverage will provide you the potential for an additional 60-100% more income for your retirement without the typical risks associated with leverage.

You Are Not Saving Enough

- The average savings rate of successful professionals is 9-12% of salary. The required savings rate to maintain your lifestyle, on average, is 30-35% of salary.

- Maintaining your lifestyle ranks at #1 or #2 on all financial concern surveys. More than 3 out of 4 of successful professionals are chronically under saving.

- You have a Retirement Gap: How do you increase your actual Current Savings Rate to the necessary Lifestyle Savings Rate?

Kai-Zen® Offers A Solution

Kai-Zen® can fill your Retirement Gap so you can Maintain Your Lifestyle in Retirement. Please scroll down to learn more about how Our Banking Group Supplies The Leverage needed, and how Kai-Zen® can protect you from the 3 Market Risks That Could Ruin Your Retirement Income.

Our Banking Group Provides The Leverage

Our Bankers Will Add Up to $3 for Each $1 You Commit to Your Kai-Zen Plan. This Leverage Is So Important To Achieving Your Retirement Income Goal Because How Much You Invest Has A 3-Times-Greater Impact On Your Future Annual Retirement Income Than Your Asset Allocation.

Source: Retirement Success: A Surprising Look Into The Factors That Drive Positive Outcomes (by David M. Blanchett, QPA, QKA & Jason E. Grantz, QPA)

3 Major Risks Could Ruin Your Retirement Income

Capital Risk

Do you worry about Not Having Enough Money To Retire, or Outliving Your Retirement Funds? That's Capital Risk.

Kai-Zen substantially reduces your Capital Risk since Our Bankers Add Up To $3 for Each $1 You Commit To Your Kai-Zen Plan.

Market Risk

The Coronavirus Crash during FEB/MAR 2020 was the Fastest Fall in the history of Global Markets since the Great Depression.

Kai-Zen Plan's "0%-Return-Floor" eliminates this type of loss.

Tax Risk

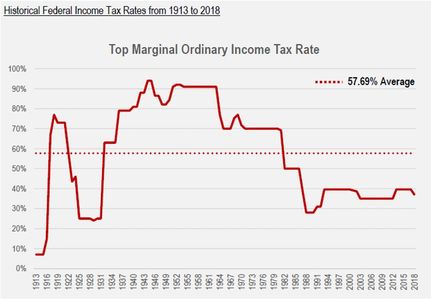

With our country's National Debt now exceeding $33 Trillion ($252,000/Household, $99,000/Person), which direction do YOU think Tax Rates are going? As you can see in this chart, from 1932-1982 the Top Marginal Tax Rate in the US never went below 60%.

Kai-Zen addresses Tax Risk with Future Tax-Free Distributions.

Kai-Zen's Bankers Add Up To $3 For Each $1 You Commit to Your Kai-Zen Plan - Dramatically Increasing Your Savings Rate.

Kai-Zen Helps Protect You Against The 3 Major Risks That Can Ruin Your Retirement Income.

Don’t Simply Retire. Have Something to Retire to.

Your retirement will cost you an average of 6 times more than your house. Most people use financing to live in a better house, so why aren’t you using financing to help you fund a better retirement?

Kai-Zen For Individuals

"Kai-Zen is the most compelling option I have seen in my search for a solution to maintain my current lifestyle in retirement."

Head of Private Bank Life Insurance

Leading Top 10 U.S. Bank

Kai-Zen Client

What People Are Saying About Kai-Zen

Why did this Executive choose Kai-Zen?

Why did this Real Estate Agent choose Kai-Zen?

Receive Up To A $3-to-$1 Match For Funding Your Retirement

I look forward to hearing from you.

Retirement Gap Solutions

Kevin S. Olson || Managing Partner

Copyright © 2019-2026 Retirement Gap Solutions - All Rights Reserved.

The information contained on this website does not constitute legal or tax advice. Legal advice, including tax advice, must always be tailored to your circumstances, and nothing on this web site should be viewed as a substitute for the advice of a competent attorney and tax advisor.